Table of Content

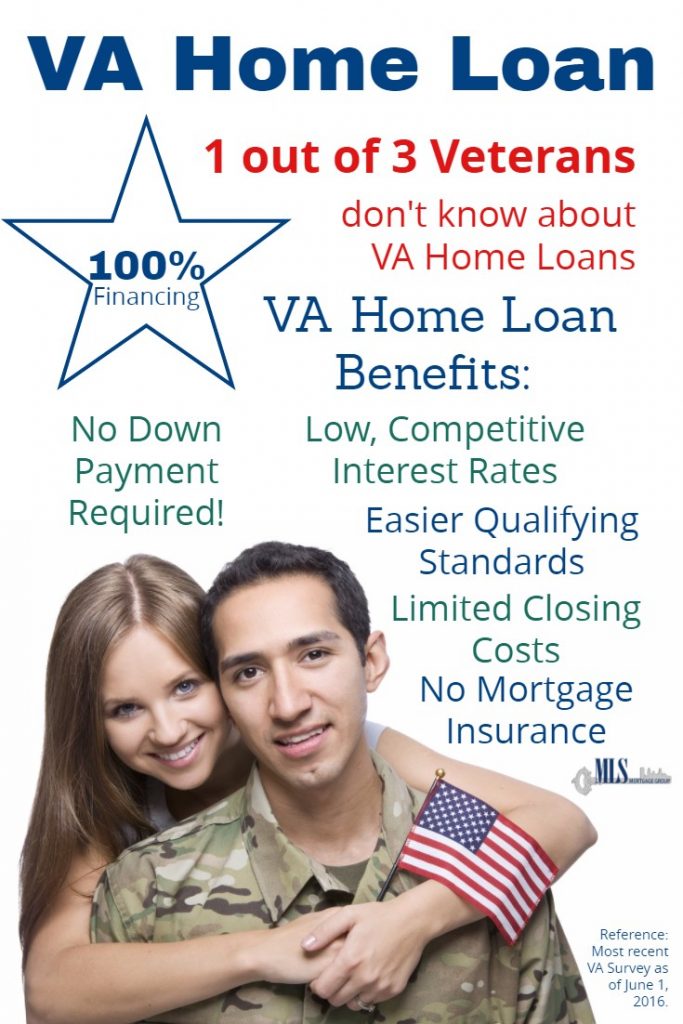

No, since VA loans are backed and guaranteed by the US government, private mortgage insurance is not required. This, in addition to zero down payments and lower interest, Could save VA loan borrowers throughout the mortgage's term. A mortgage refinance replaces your current home loan with a new one. Often people refinance to reduce the interest rate, cut monthly payments or tap into their home’s equity. Others get a mortgage refinance to pay off the loan faster, get rid of FHA mortgage insurance or switch from an adjustable-rate to a fixed-rate loan. Contacted him about buying a home and he was great to work with.

I was moving to Louisville Ky to take a new job and he walked me through the entire process. He explained to me all the different options for FHA, VA, USDA mortgage loans and credit score requirements versus Fannie Mae. Since I was a first time home buyer I needed alot of help and guidance. Fast to respond and available to answer questions that I or my realtor had after hours.

FHA mortgages

Disabled service members in Kentucky, who own property, are entitled to a tax exemption of up to $36,000 if the former military member is 100 percent disabled as a result of their service. However, veterans without their full VA loan entitlement are still bound to Kentucky’s VA loan limits. Homeownership in Kentucky is a dream for many people, but not everyone has access to a loan program as great as the VA home loan. So whether you are looking to settle down surrounded by beautiful ranches or pristine lakes, you’ll be thrilled with your new home. Not affiliated with the Dept. of Veterans Affairs or any government agency. Collection accounts are account for a debt that have been submitted to a collection agency by the creditor generally due to nonpaym...

Platinum Mortgage, LLC strives to ensure that its services are accessible to people with disabilities. Whether you're buying your first home or your dream home, we have a mortgage solution for you. When you lock the interest rate, it can’t be changed during a specified period.

VA mortgages

Certificates of eligibility allow applicants to demonstrate their history of military service to a lender. COE's can be obtained by veterans, active members of the military or national guard and families of service members. Depending on the applicant's service history and current status, the conditions for providing proof of service can vary. We offer VA home loan programs to help you buy, build, or improve a home or refinance your current home loan—including a VA direct loan and 3 VA-backed loans. Learn more about the different programs, and find out if you can get a Certificate of Eligibility for a loan that meets your needs. He is an ex-army guy so he could relate to my past experiences of being a veteran and moving around the country a lot.

For example, if you're purchasing a home in Lexington, KY, you'll need to find a lender licensed in Kentucky to do the loan. With the average listing price of a home in Kentucky landing at $308,449, the VA loan’s signature $0-money-down benefit is a considerable advantage for Kentucky homebuyers. Before you buy, be sure to read the VA Home Loan Buyer's Guide. This guide can help you under the homebuying process and how to make the most of your VA loan benefit.Download the Buyer's Guide here. Despite our efforts to make all pages and content on Platinum Mortgage, LLC website fully accessible, some content may not have yet been fully adapted to the strictest accessibility standards. This may be a result of not having found or identified the most appropriate technological solution.

VA Benefits

People often get a cash-out refinance and a lower interest rate at the same time. Just contact us and we’ll be delighted to assist you in getting a home construction loan and building your dream home in Kentucky or wherever you may need it nationwide. We do everything as a one-time close which means when you close on the construction loan you don’t have to go through the underwriting process again, saving you time and money. Veterans Treatment Court is a special system that helps veterans to combat mental health and substance abuse challenges. It's offered as part of Kentucky's court system and uses the resources of drug courts, county attorneys, VA medical centers, and county social service agencies. This web site is not the FHA, VA, USDA, HUD or any other government organization responsible for managing, insuring, regulating or issuing residential mortgage loans.

They may also require you to meet additional standards before giving you a loan. These standards may include having a high enough credit score or getting an updated home appraisal (an expert’s estimate of the value of your home). VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.

Another way to reduce the monthly payment is to extend the loan term — say, from 15 years to 30. The drawback to extending the term is that you pay more interest in the long run. You and your family can realize the dream of owning not only just a home but a custom home built just for you and your family just the way you like it. The VA offers guarantees to private lenders so that they can offer these and other great benefits to both veterans and current military personnel. We restrict access to nonpublic personal information about you to those employees who need to know that information to provide products or services to you. We maintain physical, electronic, and procedural safeguards that comply with federal regulations to guard your nonpublic personal information.

You'll need to include a copy of your discharge document. Kentucky's High School Diploma Program is a special benefit for some of Kentucky's brave veterans who served in World War II, Korea, or Vietnam. If you weren't able to graduate from high school because you left to serve in one of those wars, you can now get the an official diploma from your high school. If you'd like to apply for admission, you can click the "Apply for Admission" buttons on the right-hand side of the Veterans Centers page. Each facility has its own application, so make sure you click on the one you're interested in.

That change can increase or decrease your monthly payment. APR calculation assumes a $725,000 loan with a 25% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees, if applicable. If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Non-conforming rates are for loan amounts exceeding $647,200 ($970,000 in AK and HI). Jumbo Loans - Annual Percentage Rate calculation assumes a $940,000 loan with a 20% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees if applicable. Jumbo rates are for loan amounts exceeding $647,200 ($970,800 in Alaska and Hawaii).

You file an application, go through the underwriting process and go to closing, as you did when you bought the home. Submit all applications within a two-week period to minimize the impact on your credit score. Interest rates on adjustable-rate mortgages can go up over time.

No comments:

Post a Comment